Enhancing Risk Management Strategies in the Financial Sector with Riskify

19 Feb 2025

By Riskify

.png&w=3840&q=75)

(2).png)

Risk management is one of those very sensitive areas in the financial industry. It refers to the process of identifying, assessing, and controlling threats to an organization's capital and earnings.

The threats or risks may emanate from several sources. They include financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters.

In such complex and dynamic financial environment, risk management strategies become much relevant. They help an organization in the area of reduction of risk, facilitating compliance with regulatory requirements, and decision-making with a proper perspective.

However, they cannot be easily implemented, due to the subtlety of related issues concerning this compliance management and risk mitigation.

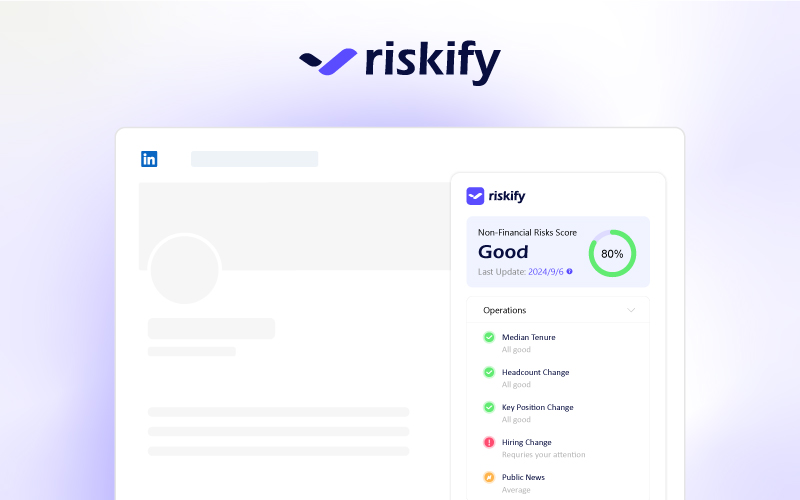

Enter Riskify, an app designed to augment risk management strategies within the financial industry. It will ease the burden of identification and assessment of risks—financial and non-financial—by firms.

Riskify further provides real-time monitoring of such risks through data and insight, allowing the firm to proactively manage such risks while concurrently aligning its strategy with the very regulatory requirements.

Since this article covers some very essential strategies involved in risk management, one of the key areas discussed is how Riskify helps any given organization negotiate through the intricacies involved in the process of risk management. We shall also look at how Riskify proves helpful in conveying principles involved in risk management and subsequent adherence to regulatory frameworks for making informed investment decisions.

Understanding the Strategies in Risk Management

The financial institutions rely on risk management strategies in the face of uncertainties in a constantly moving market. This helps the organizations to protect their assets, reputation, and stability.

Possible threats are assessed by any effective risk management strategy followed by the installation of controls that will reduce these threats. Such a process requires proactive planning and regular monitoring.

The main points that will be addressed in any risk management strategies will include:

- Identification of Risk: Identifying those risks that are most likely to affect the organization.

- Assessment of Risk: The likelihood of occurrence and the potential impact of such risks are assessed.

- Control of Risk: Establishment of measures to mitigate or reduce the identified risks.

- Monitoring of Risk: Continual monitoring and reviewing of the risks for effective management.

These elements combined give a holistic approach to the expected and unexpected problems. The more complex the financial markets become, the greater the need for dynamic framework of risk management.

An effective risk management plan bolsters not only the decision-making process but also compliance with regulatory standards. It matches an organization's risk appetite with its business goals so it can take up opportunities with confidence.

The Role of Risk Management in Finance

Every financial organization works within an environment full of risks; hence, the risk is part of its daily activities. Therefore, proper risk management is very essential to the attainment of financial stability that could ascertain sustainability in the long run.

When the financial institution gets a financial shock or experiences disruption, the stakes become very high and will call for firm and immediate actions.

Proper risk management helps in the minimization of losses and in maintaining operational efficiency. It makes an institution more resilient to stand up against adverse conditions.

It is, however also about capitalizing on the opportunities. By understanding and managing the risks, financial institutions can make strategic decisions to improve their competitive advantage.

Defining Risk Management Strategies

The organized plans that organizations set into action with the sole purpose of meeting the probable risks are called risk management strategies. Identification, evaluation, and risk reduction before the occurrence is the mainstay of the strategy.

A risk management strategy in essence is found on a series of integrated activities. They bring about a systematic approach toward the management of uncertainty.

They include the activities of quantitative and qualitative risk assessment to identify the consequence and probability of occurrence of a risk. They also include the mitigation plans, which are responsive to identified threats.

Effective strategies of risk management, therefore, are those designed to fit an organization in terms of its particular need and risk profile, and they require continuous monitoring and revision as circumstances change.

Well, at the tail end of the day, the well-planned risk management strategies embolden organizations to take on uncertainties with confidence. They put forth a roadmap on how one can keep stability in sight while pursuing growth.

Introducing Riskify: A Tool for Modern Risk Management

In an evolving financial complexity, Riskify is one of those innovative tools that change the face of risk management. The solution helps financial institutions automate their risk assessment procedures. It provides the technology for better strategic planning.

One of the distinguishing features of Riskify is the ability to combine risk data with automation capability in complicated analysis for an improved decision regarding both the financial and non-financial dimensions. Its capabilities certainly extend beyond traditional risk management on many counts.

The tool uses real-time data to monitor risks. This helps in proactively identifying possible threats at an early stage. Riskify, therefore, decreases vulnerabilities and reinforces institutional resilience.

Further, the adaptive capabilities of Riskify have been aligned with the changing needs of each organization; it has been engineered in such a way that it meets the specific risk appetites of particular institutions. Such tailoring ensures that financial entities preserve compliance while optimizing performance.

Such tools represent a great stride in the area of risk management. Now, with the embedding of Riskify within their frameworks, financial institutions can approach these complexities with much more confidence and efficacy.

What is Riskify, and how does it work?

Riskify is the integrated risk management software developed specifically to meet challenges arising in a modern financial landscape, making risk assessment easier and enhancing decision support. It has an easy-to-use interface; clarity has been brought into otherwise convoluted processes in risk management with Riskify.

It does so by collecting and analyzing big data sets. The data includes historical and real-time streams that portray trends and risk factors as they happen. Such analysis will allow an institution to point out present and predictive risks.

Riskify provides real-time analytics and simulation of risk scenarios to the user. The features complement the awareness of possible impacts hence offering preventive measures. It is easily integrated with the already existing infrastructure ensuring a smooth adoption.

Benefits of using Riskify in Financial Institutions

The use of Riskify comes with many benefits for financial institutions looking to solidify their risk management practices. It saves up to a great deal of time and effort while carrying out complicated analyses, hence increasing operational efficiency.

The aggregation of non-financial risk factors into risk assessments extends the scope of supervision. In that way, institutions are able to have a full view that allows them to protect their assets fully.

In the end, Riskify affords more strategic decision-making through clear, actionable insight. That is, the financial institution can solidify its risk management posture while assuring greater regulatory compliance with this most powerful tool.

Critical Elements of Risk Management under Riskify

The modern-day financial industry demands the correct knowledge of, and application of, risk management. And with Riskify in place, the critical elements are made part of the enhancement of the process. Below is a step-wise transformation by Riskify to risk management.

Company Risk Identification and Assessment

Effective risk management starts with the identification of risk. The strength of Riskify lies in correctly identifying the areas of potential risk within a company. The tool uses data analytics to spot tendencies and unusual trends.

Risk assessment involves looking at the potential impact of the risks to the company. Riskify offers tools that quantify these risks so that institutions can understand their magnitude. This evaluation is important for the prioritization of risk response strategies.

A holistic risk assessment should include:

- Historical data: Learning from past events in order to predict future risks.

- Risk categories: Categorization of risks as financial, operational, strategic, etc.

- Likelihood and impact: Assessment of how likely and serious a risk could be.

Riskify allows for dynamic risk assessments. This essentially means that as soon as new data is made available, it will update the risk profiles. Keeps organizations always informed of the current risk landscape.

Moreover, Riskify makes the communication of risk assessment easier with automated reporting. This keeps all stakeholders on the same page with regard to risk.

Monitor Financial and Non-Financial Risks

Risk monitoring is very important in ensuring risks are kept at bay. The different kinds of risks faced by financial institutions, both financial and non-financial, can be monitored by Riskify in real time.

The financial risks include credit, market, and liquidity risks. These can be monitored only through real-time data analysis. The analytics tools available within Riskify allow for the rapid identification of changes in these risk categories.

It also needs to monitor non-financialrisks such as regulatory, compliance, and reputational risks. Within Riskify, compliance obligations and reputational signals are monitored for early warnings of impending issues.

Some of the components of a good risk monitoring framework would include:

- Continual data feeds: Keeping pace with live information.

- Alerts and notifications: Staying informed of material changes in a timely manner.

- Trend analysis: Identifying how risks evolve over time.

The Riskify dashboard provides a unified view of all financial and non-financial risk metrics in one place, ensuring that no aspect of risk is missed. Further, risk scenarios and stress testing give a proactive outlook. With these components, Riskify helps an institution prepare for possible adversities with the view of enhancing resilience and reducing the time to respond.

Conclusion: From identification to monitoring of risks, Riskify helps build a strong framework in risk management for any institution. Through this, they can properly meet both prevailing challenges they face today and those marching into the future.

Overcoming Challenges of Communication: Risk Management

The risk management communication is a requirement yet challenging. The complexities in the concepts of the risk need to be simplified for better interpretation among the teams. The miscommunication might lead to an oversight and inefficiency.

Riskify fills this gap in communication. Translate complex data into understandable, clear, and concise insights with reporting tools for improved decision-making at any level within an organization.

The risk management officers will, therefore, have to communicate the risks in a language that makes sense, taking the data-laden analysis and turning it into everyday language, so the teams can easily understand what might be impacted and what has to be done.

With a user-friendly platform, it turns out to be quite easy to get on board non-expert stakeholders. Dashboards and visualization tools present the data in a very palatable manner, which definitely makes the environment collaborative and informed.

The gap existing between effective communication finally leads to alignment of priorities. These institutions benefit from cohesion in efforts toward mitigation against possible threats. This can be done by organizations that seek to enhance internal communication using tools like Riskify.

How to Break Down Complex Ideas for Your Team

The details of complex risk management can overwhelm a team. In case the concepts are to be put into practice, they have to be simplified. Riskify offers intuitive dashboards that distill even the most complex risk analysis into visual representations.

Now, breaking down a concept involves using simple language with everyday examples. Leaders need to ensure that what they communicate does not contain jargon. The style will help bring down complex risk factors so the whole team is on board.

Big ideas, boiled down, give teams confidence to act. The more an organization knows, the stronger the collaboration will be. In order for organizations to succeed, they can adopt clear communication approaches, even in challenging risk environments.

Strong Risk Communication Strategies

It is always very important for any given organization to clearly communicate risk strategies in order to achieve success. First, it is necessary to have common language regarding risk. That will involve coming up with ordinary terms and understanding across an organization.

This can only be achieved with regular training sessions and workshops. The sessions really help to enforce the concepts of risk and ensure that learning is a continuous process. The efforts are complemented by Riskify through real-time data, which aids in regular updates.

Lastly, it is through the use of feedback mechanisms that communication may be improved. Allowing team members to air out their questions and concerns means that the gaps are brought to light and addressed accordingly. That openness in the practice of risk management is nurtured.

Their implementation will go a long way in improving the way the organization communicates its risks. More importantly, the engaged and informed teams will be able to take appropriate action against the probable threats.

Regulatory Adherence and Proactive Risk Management

The dynamic nature of financial regulations demands compliance. Very often, regulators update guidelines, increasing complexity in compliance management. Proactivity is thus required from institutions to ensure effective alignment with such changes.

That is whereRiskify comes handy. It helps in automating the tracking of regulatory updates for an organization. In this way, compliance policies remain updated and efficient.

Compliance minimizes financial exposure and maximizes reputation. It saves institutions from fines and potential litigations. What's more, it builds trust with customers, stakeholders, and regulatory bodies.

Proactive compliance strategy implies preparations upfront for likely changes. That is, there needs to be a continuous assessment of risk and flexibility in the manner of implementing the strategies. Organisations have to be nimble in responding quickly to changes in regulations.

Some of the most important constituents of proactive risk management are:

- Continual monitoring of the regulatory environment.

- Putting in place dynamic compliance frameworks.

- Inculcating technology to achieve seamless adaptation.

With a view toward proactive measures and compliance with regulations, the institutions protect their operations. It empowers them to confidently undertake complex financial landscapes. These strategies drive them, once implemented, toward sustainable growth and stability.

Master Regulatory Changes with Riskify

Regulatory changes can be difficult to navigate through without the right tools. Riskify becomes a trusted ally in making the way forward easier for compliance by offering one place to monitor and manage all the compliance data.

Takes away the burden of knowing new regulations by automating updating compliance checklists and removing manual efforts, so your teams are always in step with the latest standards.

Besides, Riskify allows users to gain granular insight into trends in regulation and foresee probable changes. A proactive warning is given to users of this system before it happens; hence, an organization makes suitable decisions that will evade the possibility of non-compliances.

Proactive compliance means constant vigilance and strategic foresight—way beyond simple reactionary measures. It's how organizations that see further ahead manage their risks.

Underpinning proactivity, Riskify uses predictive analytics to empower an organization in identifying potential threats even before they start blowing out of proportion. That way, there becomes a possibility of prevention rather than just reacting.

Underpinning the culture of continuous improvement is proactive compliance. Further supported by training and audits at appropriate intervals, this keeps the compliance standards high. Thus empowered, the organizations are more able to rise above mere regulatory requirements and therefore assure long-term success and resilience.

Investors and shareholders have become sensitive to both financial and non-financial risks. These risks highly affect investment performance as well as the value of a company. There has been an increasing demand for risk exposure transparency by the financial institutions in the recent past.

Riskify provides unparalleled insight into the risk profile of a company. Investors on the platform can gain insight into the details concerning quite a number of various risk factors. These would include risks about specific companies, but also more generalized market trends.

Understanding these risk profiles gives investors, in essence, the upper hand in aligning investment with both risk appetite and ESG priorities; access to real-time data now enables them to make decisions around that data.

Institutional transparency in the reporting of risk will generate confidence among investors. There should be clarity on what the institution is doing to mitigate the risks identified. Such openness reassures the investor of the stability and foresight of the institution.

A well-rounded risk management framework addresses both traditional and emerging risks. It is by such an approach that it assures sustainable growth and competitive advantage. Such strategic approach is critical in finance where decisions have to move fast and be informed.

The major components of investor-centric risk management would involve:

- Holistic non-financial risk assessment

- Real-time data monitoring and trend analysis

- Effective communication of risk mitigation strategies

Understanding Non-Financial Risks and Company Exposure

The non-financial risks have turned out to be very important in establishing the long-term sustainability of an organization. Among these risks are governance, social responsibility, and environmental impact. It is very necessary that any investor understands these kinds of risks to make proper decisions.

Riskify helps organizations to effectively assess non-financial risks. It highlights how such risks impact overall performance at a company's level. This information comes in handy for investors looking forward to protecting their interests.

This will allow the investor to have a clear view of the non-financial exposures of a company. Knowledge of how an institution handles its ESG risks underpins informed investment decisions. It orients investor portfolios with their ethics- and financial-based goals.

Making Informed Decisions with Riskify Insights

In this dynamic financial world, the need for insight that is both timely and accurate becomes a must for making decisions. With Riskify, investors' hands are equipped with the required tools to analyze risks in real time. It gives an easy-to-use interface for up-to-date information and analyses.

With Riskify, one is able to discern industry trends fully. It identifies potential risks and opportunities, hence helping with informed portfolio management. Investors can now face complex market dynamics with confidence.

Moreover, Riskify has brought predictive capabilities in order to foretell possible market shifts. That kind of proactive insight allows investors the possibility of readjusting their strategies in trying to effectively mitigate the risks. This data helps one to secure investments while going for growth opportunities.

Conclusion: The Future of Risk Management in Finance

The forces of technology and regulation are going to shape the future of risk management within finance. In that respect, tools like Riskify are some of the integral ways in which risk management and mitigation will be transformed. It brings real-time data together with advanced analytics, meaning the institution is able to stay ahead of emerging threats.

Evolve risk management strategies in a changing financial landscape. A proactive and data-driven approach ensures resilience and sustainability. That type of strategic foresight will not only protect the assets but also bring trust from stakeholders, opening ways toward growth—sustained and based on competitive advantage.

Recommended Reading

(3).png)