In 2025, the tech giant Meta shocked the

entire world by announcing a massive wave of layoffs. The move had

repercussions for thousands of workers.

While financial consequences of this move

were immediately apparent, non-financial risks of such a move were not that

easily visible. Such non-financial risks are generally undertaken and can have

wide-reaching consequences.

Non-financial risks of Meta's layoffs are

discussed in this article. It attempts to shed light on the wide-reaching

consequences of business decisions.

Moreover, non-financial risk management

software tools such as Riskify, used in managing non-financial risks, would

also be discussed here. Here, we would determine how such tools can be used to

forecast and prevent potential challenges.

Overview of Meta Layoffs

In January, Meta's Chief Executive, Mark Zuckerberg, reaffirmed in a company memo the company's focus on keeping high performers on board while looking to "exit low performers more quickly." The imminent layoffs would affect around 3,600 employees, based on the company's latest headcount estimates. The move impacted over 3,600 employees in various departments. The reason for the layoffs was driven by budgetary constraint and operational efficiency.

Meta's top bosses mentioned financial pressures in terms of decreasing advert revenue and rising operating expenses as key drivers for this move. The move to new technologies also required a shake-up of the staff.

While business rationale was explained publicly, the wide-reaching consequences for staff were apocalyptic. The career dreams of employees were destroyed overnight. The shock wave hit not just those who got the axe but also across remaining staff.

The redundancies highlighted the urgent need for collective planning and risk management. The redundancies highlighted the need to take financial and non-financial risks into account when making business decisions. Overall, Meta's redundancies in 2025 provide a poignant reminder of challenges in managing large-scale reductions in force. Proper management of short-term and long-term implications is key to maintaining organizational health and stability.

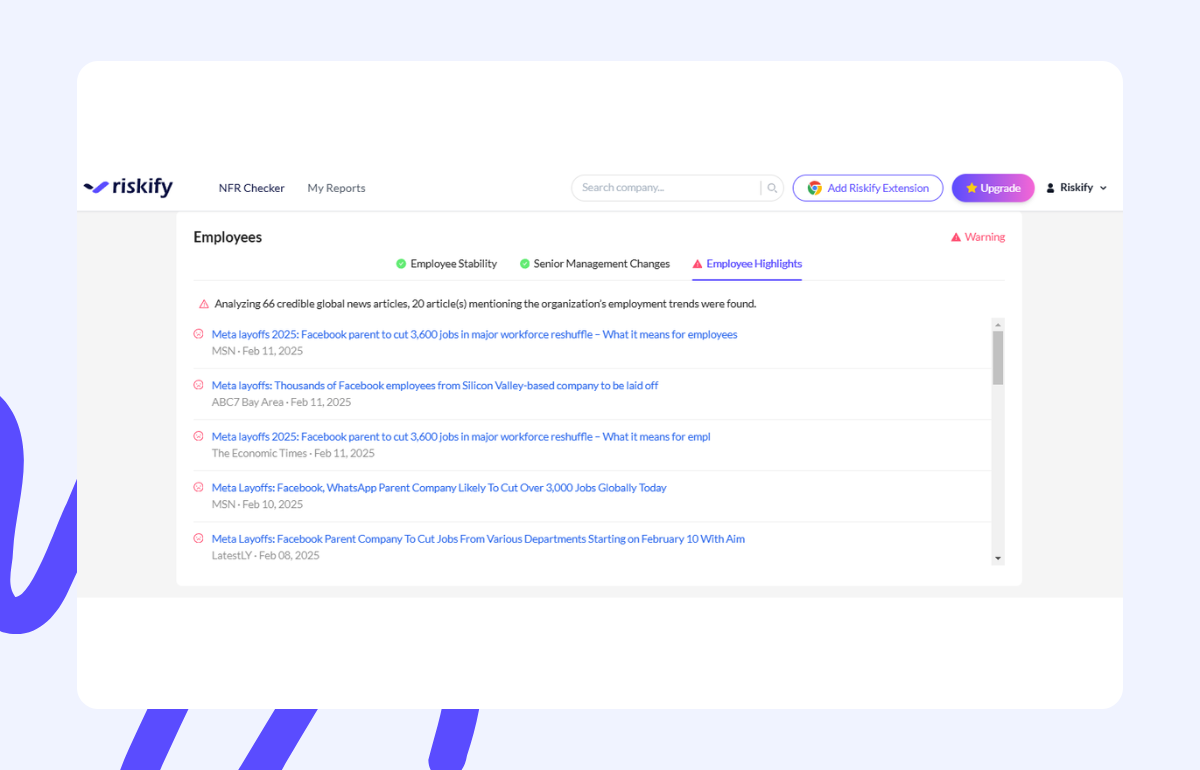

Employees Risk: Meta's Growing Challenges - As Revealed by Riskify's Non-Financial Risk Report

(3).png)

Meta's recent workforce reduction has alarmingly pushed its Employees Risk into a warning zone, as revealed by Riskify's data. The report highlights several key indicators that demand immediate attention:

Headcount Decline: A 6.35% reduction in the past 12 months signals profound restructuring. This isn’t just a number—it represents a shrinking workforce that could undermine the company’s operational backbone.

Median Tenure: At merely 4.8 years, this figure points to a potential struggle in retaining experienced talent. A less seasoned workforce risks losing the depth of expertise necessary for long-term innovation and stability.

Leadership Stability: The absence of any new senior management appointments over the past year suggests significant gaps in succession planning. Without fresh leadership, strategic decision-making can stall, further compounding operational vulnerabilities.

These intertwined factors have a cascading effect: diminished employee morale, reduced productivity, and heightened turnover, all of which threaten Meta’s overall operational efficiency. The situation is even more precarious when considering that layoffs often trigger an exodus of talent. As employees, gripped by uncertainty, seek refuge in more stable environments offered by competitors, the organization faces the peril of a significant knowledge gap. This brain drain not only disrupts day-to-day operations but also stifles the collaborative innovation vital to maintaining a competitive edge.

Riskify empowers companies to detect these early warning signals before they escalate into full-blown crises. By leveraging real-time data analytics, Riskify enables organizations to proactively identify and address these potential risks—ensuring that strategic actions can be taken well in advance to safeguard employee well-being, operational stability, and long-term growth.

Don't wait until these risks spiral out of control. Embrace Riskify to uncover and mitigate the hidden threats within your organization before it's too late.

Riskify: A Tool for Management

What is Riskify?

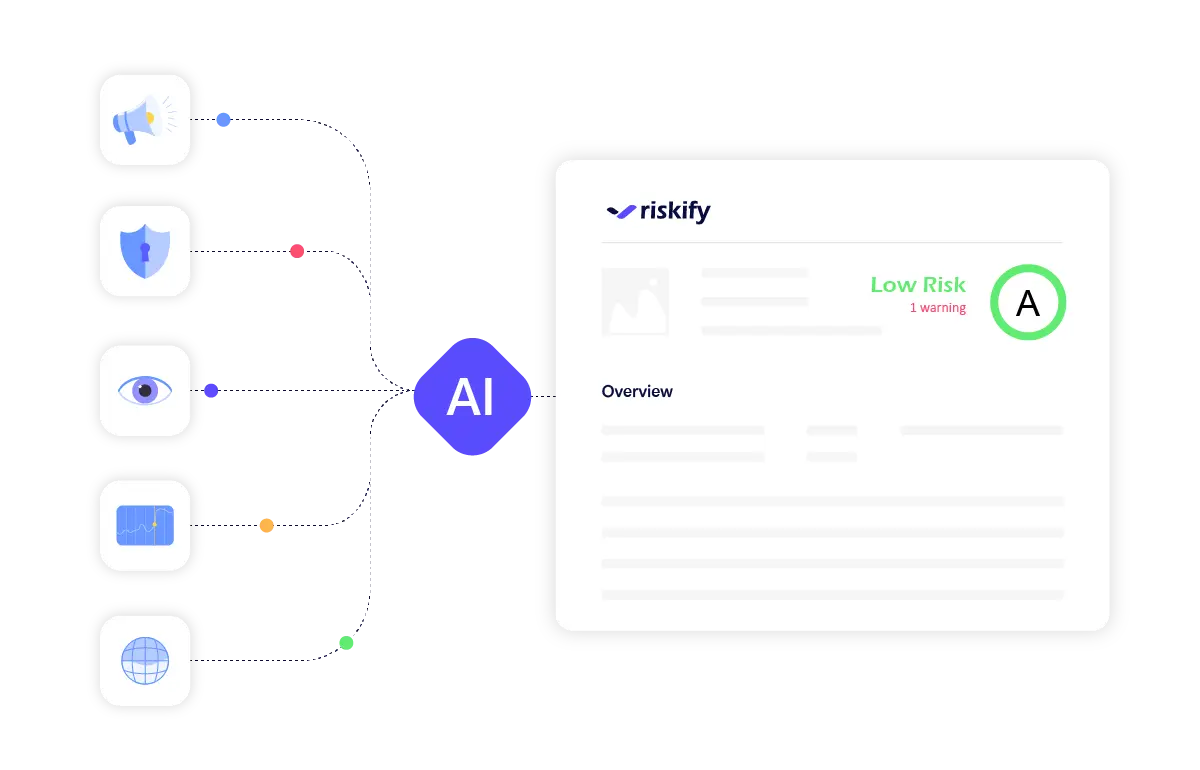

Riskify is an AI-driven platform designed to empower professionals across various roles—including procurement, compliance, risk management, investors, financial experts, and consultants—with real-time insights into non-financial risks. By combining advanced AI analytics with data from authoritative sources, Riskify offers comprehensive risk assessments that enabling organizations to proactively monitor and mitigate risks, ensuring operational integrity and long-term success.

Riskify's Non-Financial Risk Report Flags Additional Risks for Meta

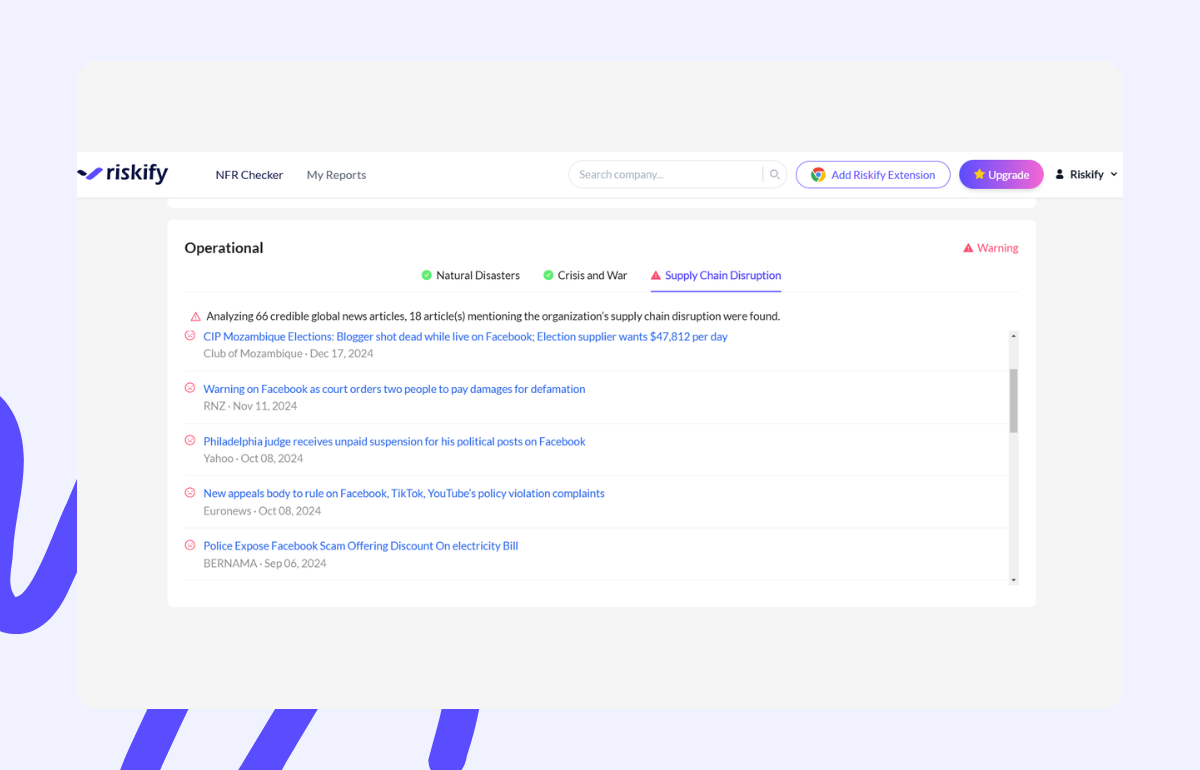

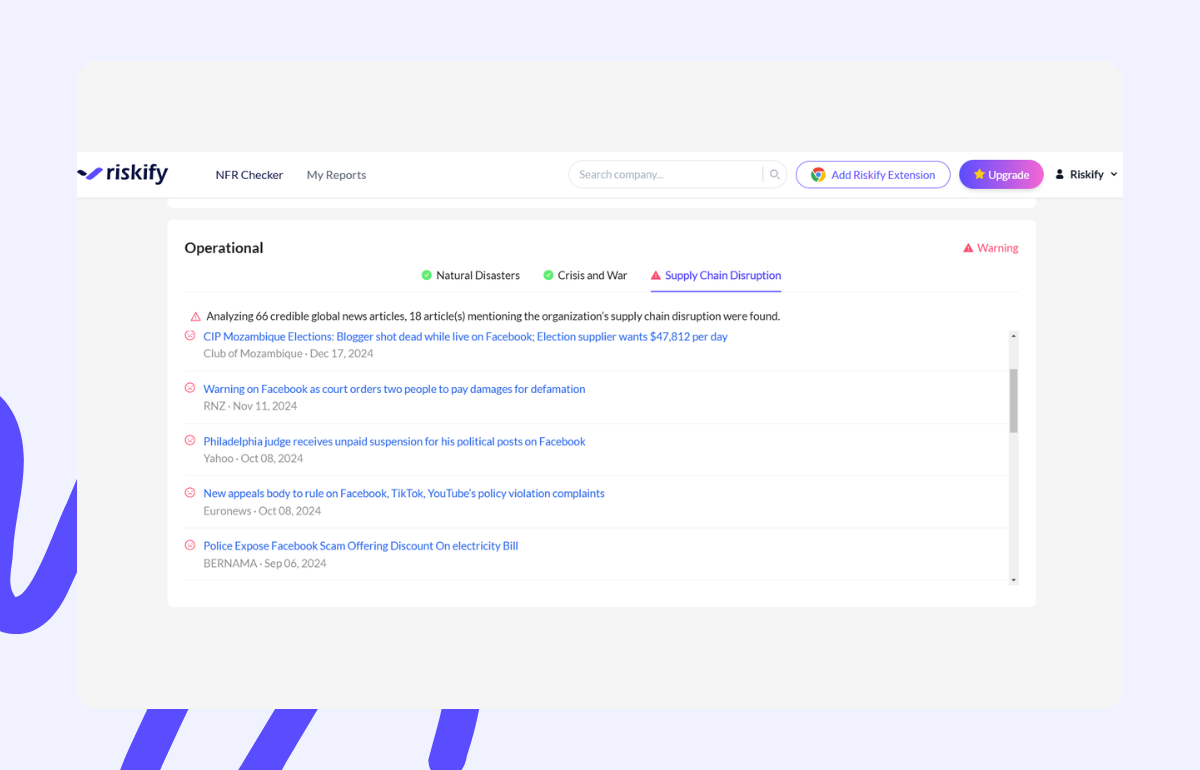

Operational Risk: Business Continuity Strain

Layoffs or dramatic business transformations negatively impact workflow and project timelines, hence compromising the consistency of Meta's performance. In addition, leadership appointment deficiencies aggravate this risk, which hinders strategic decisions and innovations.

Reputational Risk: The Power of Opinion

Mass job losses generally lead to negative media publicity, hence negatively influencing a company's perception in the public's view. The warning in respect to Meta's Reputational Risk is brought forth by wide media coverage of its redundancy decisions, hence causing concern regarding the company's stability and ethical reputation. This adverse perception is likely to dishearten customers, erode investors' confidence, and hinder talent attraction in the company.

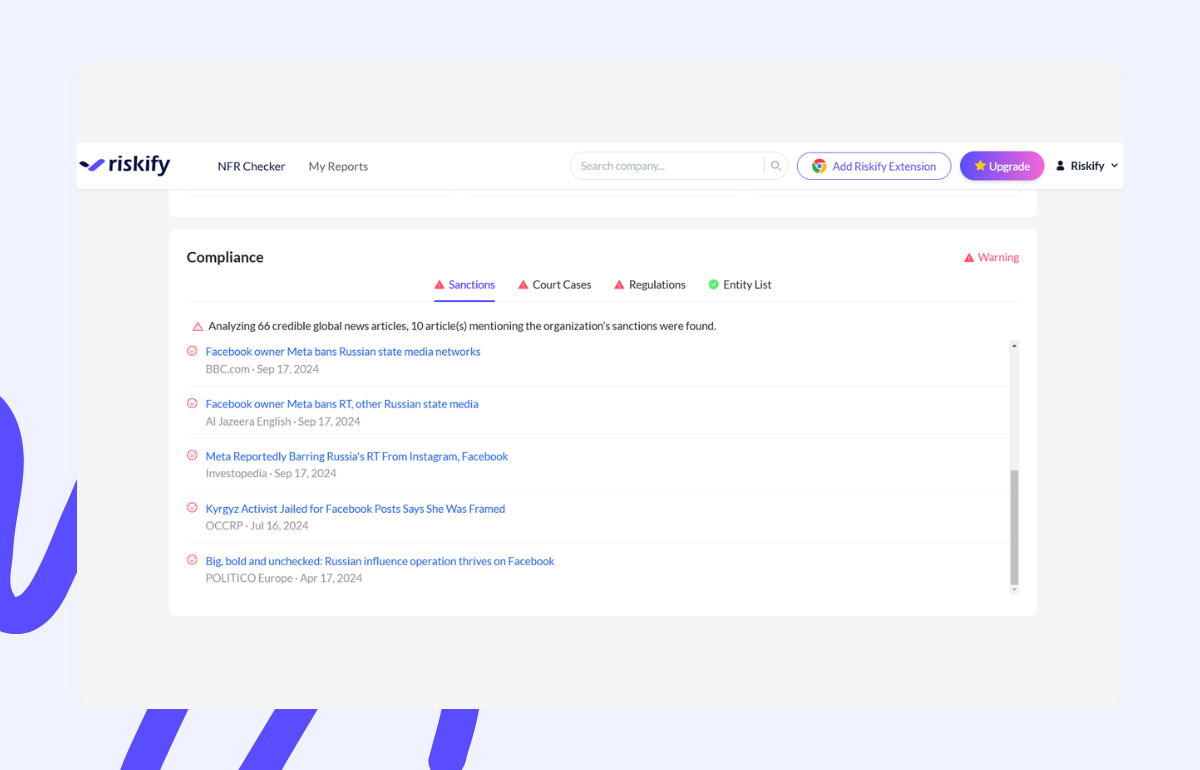

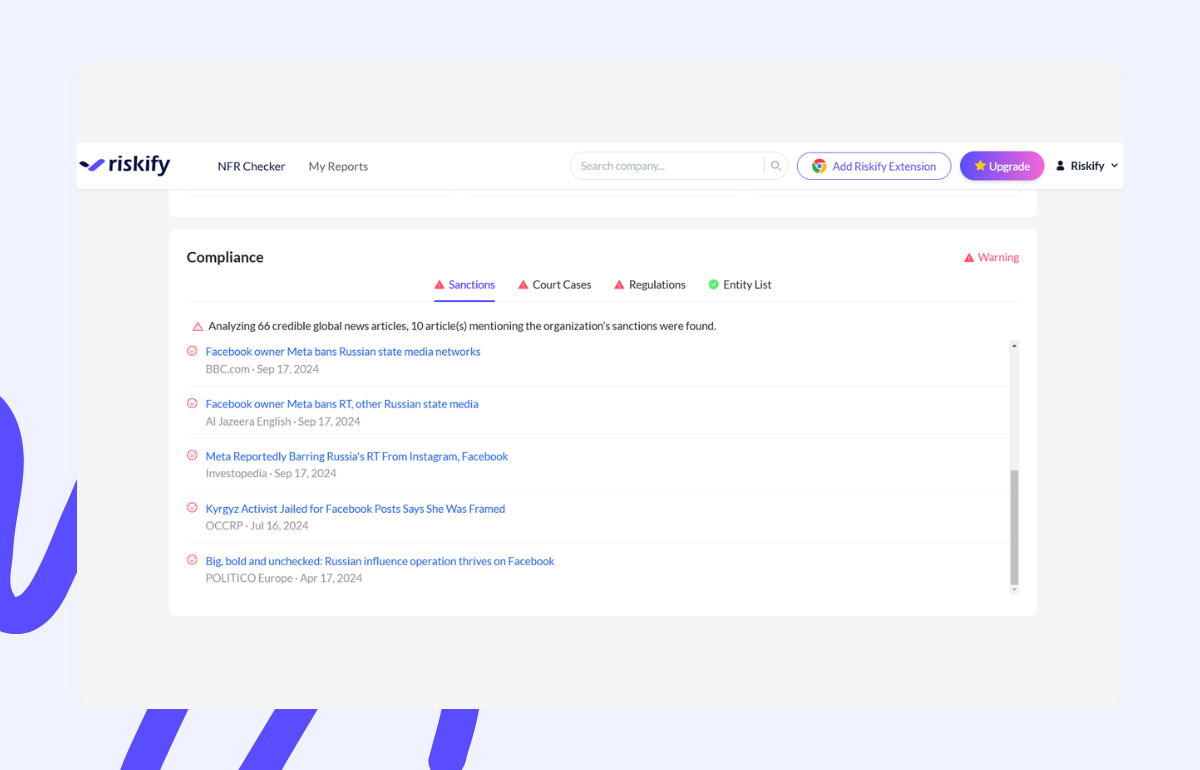

Compliance Risk: Facing Legal and Regulatory Penalties

While Meta's Compliance Risk is not related to job losses in a direct manner, it is relevant nonetheless. The incident of job losses is likely to invite litigation, expose the company to regulator scrutiny, and possibly lead to violations of labor legislations, specifically in cases of inadequate transparency or perceived unfairness in processes.

Conclusion

The Meta Layoffs in 2025: The Value of Accounting for Non-Financial Risks using Riskify

The Meta job losses in 2025 attest to the crucial importance of accounting for non-financial risks in conjunction with financial metrics. Such job losses carry serious consequences to employee motivation, business continuity, and company reputation. Non-financial risks often get inadequate attention; yet, they hold potential to deliver long-term rewards.

The utilization of Riskify allows for instant recognition and analysis of any potential business's non-financial risks in real-time. Whether it is related to staff turnover, business disruption, or reputational damage, Riskify presents in-depth analysis to support informed decision-making before a negative incident occurs.

Don't wait for the next crisis

Register for Riskify today to instantly access complete non-financial risk reports for any company, and stay ahead of potential risks.

(3).png)