Jabil’s New Gujarat Factory: Navigating Non-Financial Risks with Data-Driven Insights

07 Mar 2025

By Riskify

.png&w=3840&q=75)

Table of Contents

Strategic expansion and risk management go hand-in-hand in a rapidly changing global economy. The recent news by Jabil of a new plant in Gujarat is a clear signal that it is keen to expand its manufacturing base and build its supply chain resilience. As the company expands, though, it will also need to manage an advanced set of non-financial risks that may impact its business continuity and reputation.

Here at this blog, we present a detailed data-driven examination of the non-financial risk landscape at Jabil derived from the latest Riskify report. Through analysis of some of its key metrics along with recent news headlines, we will discuss Jabil's operational, employee, compliance, and reputational risks—along with its specific cybersecurity and ESG (Environmental, Social, and Governance) capabilities. Lastly, the analysis here will offer context regarding how Jabil's brand new Gujarat plant may solve several of those problems.

Overview of Recent Developments

Jabil's Strategic Expansion in Gujarat

Jabil has been in the news recently for opening a new plant in Gujarat, India. The news is noteworthy on more than one level:

- Expanded Production Capacity: The Gujarat facility ought to significantly boost Jabil's production capacity, serving mounting global demand and reducing reliance on traditional manufacturing hubs.

- Supply Chain Diversification: With operations now in a new geographic area, Jabil aims to mitigate risks from natural disasters, geopolitical unrest, and regional supply chain disruption.

- Regional Economic Impact: The project will create jobs and stimulate the regional economy, and Jabil will be a significant driver of the region's manufacturing economy.

Though the Gujarat expansion is a positive step, it comes at a time when Jabil's non-financial risk profile registers a number of warning signs. These risks are explored in the subsequent discussions, supported by evidence from the Riskify report.

In-depth Analysis of Jabil's Non-Financial Risks

Operational Risk

Operational risk is a key driver for any manufacturing company, and Jabil's profile currently reflects this weakness. Jabil has been highlighted with an Operational Warning in the Riskify report. What do the numbers indicate?

- Natural Disasters: Only 2 natural disasters were reported in the previous month, neither of which had any direct impact on Jabil. While this suggests a degree of resilience, the low number does not eliminate the possibility of future disruption.

- Supply Chain Disruptions: An example is the recent news article on an "Amazon Strikes Warrant Deal With Electronics Manufacturer Jabil." Such supply chain mishaps, though temporary, reflect the business network weakness of Jabil.

These findings indicate that while Jabil has escaped major disruption in the recent past, the inherent weaknesses in its supply chain still remain a risk. The strategic diversification that the new Gujarat factory can bring in may turn out to be a crucial factor in reducing such risk. By dispersing production across geographies, Jabil can dissipate the impact of localized disruption and ensure a smoother operational flow.

Employee Risk

.png)

Employee risk also poses an enormous concern to Jabil. Numbers in the Riskify report tell a story of labor volatility:

- Headcount Reductions:

- 6-month headcount reduction: –1.61%

- 12-month headcount reduction: –2.52%

- General Workforce Trends:

- The report records cumulative falls of –2.14% over 6 months and –4.09% over 12 months.

- Employee Tenure and Management Changes:

- Employee median tenure is 7.1 years, indicating a highly experienced workforce. It has, however, hired only 5 new senior managers in the past year, which indicates stagnation or leadership succession issues.

These figures call into question issues of talent retention and workforce stability. A shrinking workforce, and particularly senior management, can impact innovation and operating efficiency. The Gujarat expansion can provide an answer by opening up new avenues for talent acquisition and triggering a spurt in rejuvenation of the company's human capital. By tapping into the local talent pool in Gujarat, Jabil is in a position to reverse its shrinking headcount trends and establish a more dynamic and stable workforce.

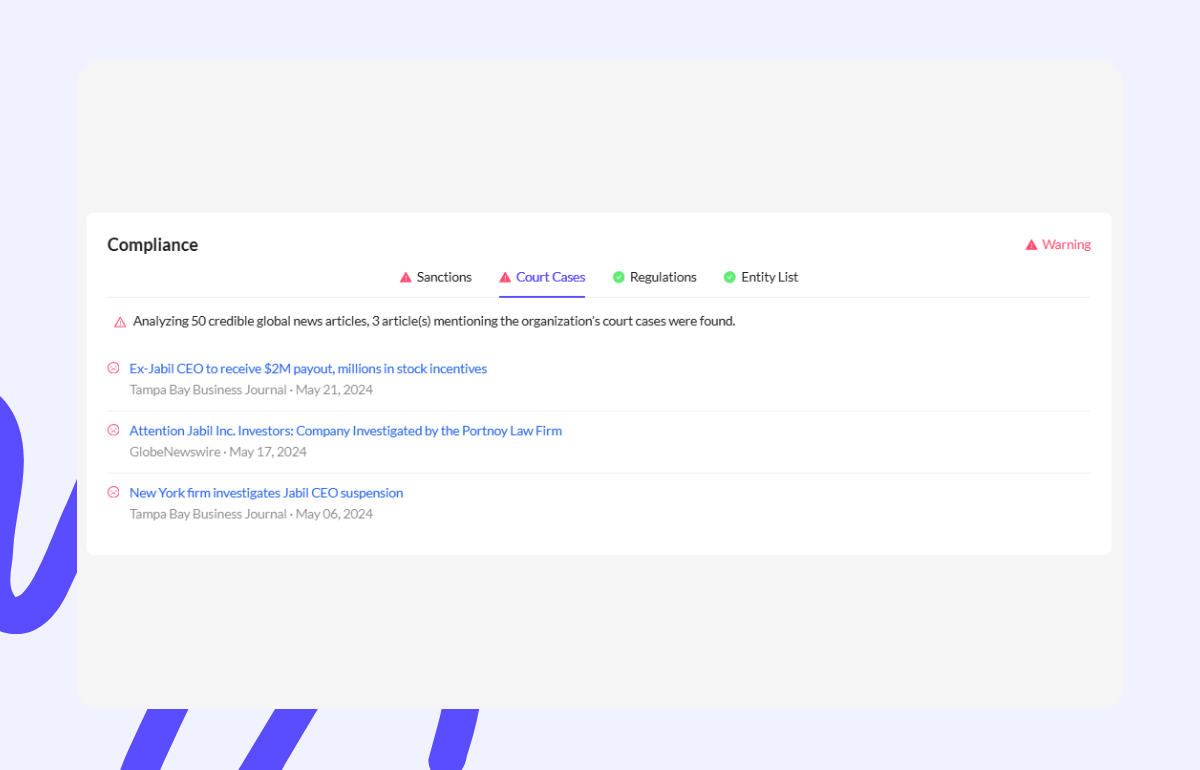

Compliance and Reputational Risk

Compliance and reputational risks are presently some of the biggest issues for Jabil. Riskify report lists several incidents that have created these risks:

- Executive Controversies and Internal Investigations:

- The most notable among these is the CEO suspension matter—while still earning a $1 million salary throughout the period of the internal investigation. This has raised some extremely valid corporate governance and executive accountability issues.

- Legal Disputes:

- There have been several reported cases in court, the latest being that of a retired CEO who was supposed to receive an exit package of $2 million. Such a lawsuit not only raises financial uncertainties, but also brings disrepute to the firm.

- Public and Regulatory Scrutiny:

- The regularity of such occurrences, as per different news reports, mirrors a pattern of governance problems that can discourage investors and undermine stakeholder trust.

The implications of these compliance issues extend beyond regulatory penalties. They have a direct impact on Jabil's brand reputation, which is critical in the highly competitive electronics and manufacturing sectors. Jabil must enhance its compliance systems and make its corporate governance processes more transparent to regain the confidence of the market and to remain in its position.

Cybersecurity and ESG Strengths

Contrary to the fears, Jabil exhibits exemplary strengths in ESG and cybersecurity domains—two domains growing in significance in the modern business landscape.

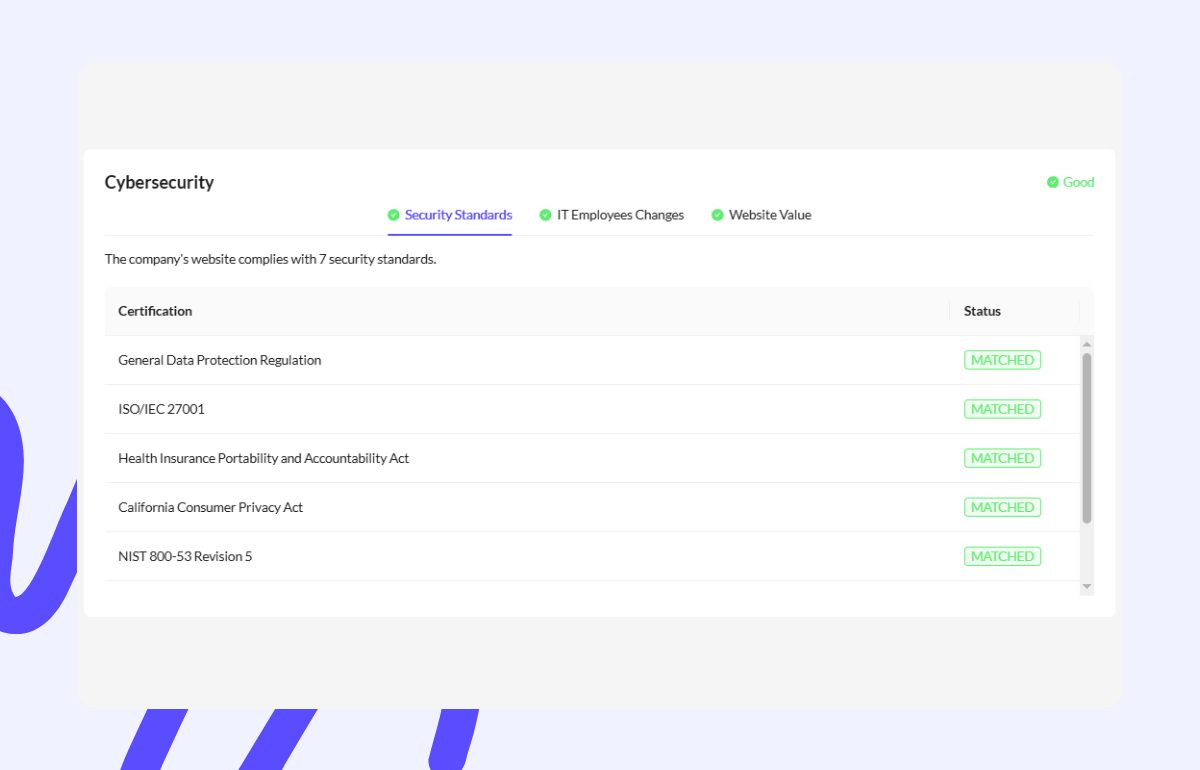

Cybersecurity

- Compliance with Key Security Standards:

Jabil adheres to 7 important security prerequisites, which are:

- GDPR

- ISO/IEC 27001

- HIPAA

- CCPA

- NIST 800-53

- Cybersecurity Maturity Model Certification

- CIS Controls

- Supporting Data:

- Its web infrastructure is supported by approximately 236.28K monthly website traffic and $127.69K yearly IT expenditure.

These measures illustrate Jabil's commitment to protecting its digital assets and confidential information from cyber attack. In the modern era where cyber attacks are increasingly sophisticated, such strong cyber security is a reassuring mechanism.

ESG (Environmental, Social, and Governance)

- International ESG Benchmarks:

Jabil's ESG performance is underpinned by internationally recognized standards such as ISO 14001 and the Sustainable Finance Disclosure Regulation. Adherence to these standards ensures that the company meets minimum environmental and social criteria.

- Sustainability Initiatives

The Gujarat facility is planned to incorporate cutting-edge sustainable design principles, further strengthening Jabil's ESG footprint. The commitment here not only reduces environmental risk but also reflects positively on the company's reputation as a responsible corporate citizen.

The cybersecurity and ESG strength is an effective counterweight to the above-mentioned operational and reputational risks. Not only do these strengths protect Jabil from external threats that may arise, but they also provide it with a competitive advantage in an increasingly sustainability-focused market.

Conclusion

Jabil's journey in a rapidly evolving world is paved with both daunting threats and heartening opportunities. The latest Riskify report offers a facts-based snapshot of the company's non-financial risk profile, pointing to exposures in operations, labor practices, and corporate governance. With such obvious indicators as declining headcount, infighting, and litigation, it is apparent that robust risk management practices must be in place to fend off these threats.

Meanwhile, Jabil's robust investments in ESG practices and cybersecurity offer a good platform for resilience in the future. The new factory that is being set up at Gujarat is also a strategic initiative to diversify production bases and access new talent pools, which would decrease operational risk and enhance stability overall.

Going forward, continued monitoring of Jabil's non-financial risks is essential. Visit us at Riskify to see other companies' non-financial risks and more best practices in risk management.