TSMC in the Spotlight: Navigating Strategic Expansion with Comprehensive Risk Insights

06 Mar 2025

By Riskify

Table of Contents

Taiwan Semiconductor Manufacturing Company (TSMC) stands at a crossroads today, as it makes a significant investment commitment with the Trump administration to spend $100 billion to shore up chip production in the United States. TSMC is confronted, as it embarks on its onshoring project, with a multifaceted challenge set that transcends pure cost and operational considerations, such as non-financial risks. Riskify's non-financial risk report gives a comprehensive picture of material issues, adopting a long-term perspective that is not limited by the restrictive focus of traditional financial metrics.

A Definitive Agreement with Far-Reaching Consequences

In a highly publicized ceremony at the White House, TSMC CEO CC Wei and President Trump revealed that TSMC would be further expanding its U.S. manufacturing presence with the building of five new chip plants. Not only is this deal a strategic attempt to re-establish U.S. semiconductor manufacturing, but it is also a definitive statement in light of the current geopolitical competition with China.

The key terms of the agreement are:

- Onshoring for Security: By bringing advanced chip production to U.S. soil, the deal aims to bolster national security and mitigate supply chain vulnerabilities.

- Economic and Market Ripple Effects: Such an unprecedented investment is expected to have a significant impact on capital markets, attracting attention from investors globally.

- Strategic Leverage: The administration’s push for domestic manufacturing is seen as a countermeasure against external pressures, particularly from China.

Riskify Non-Financial Risk Report Takeaways

Aside from the most significant financial indicators, Riskify's TSMC non-financial risk report also examines the overall risks that can affect the long-term sustainability of the business. It is more than the conventional measures as it conducts an analysis of:

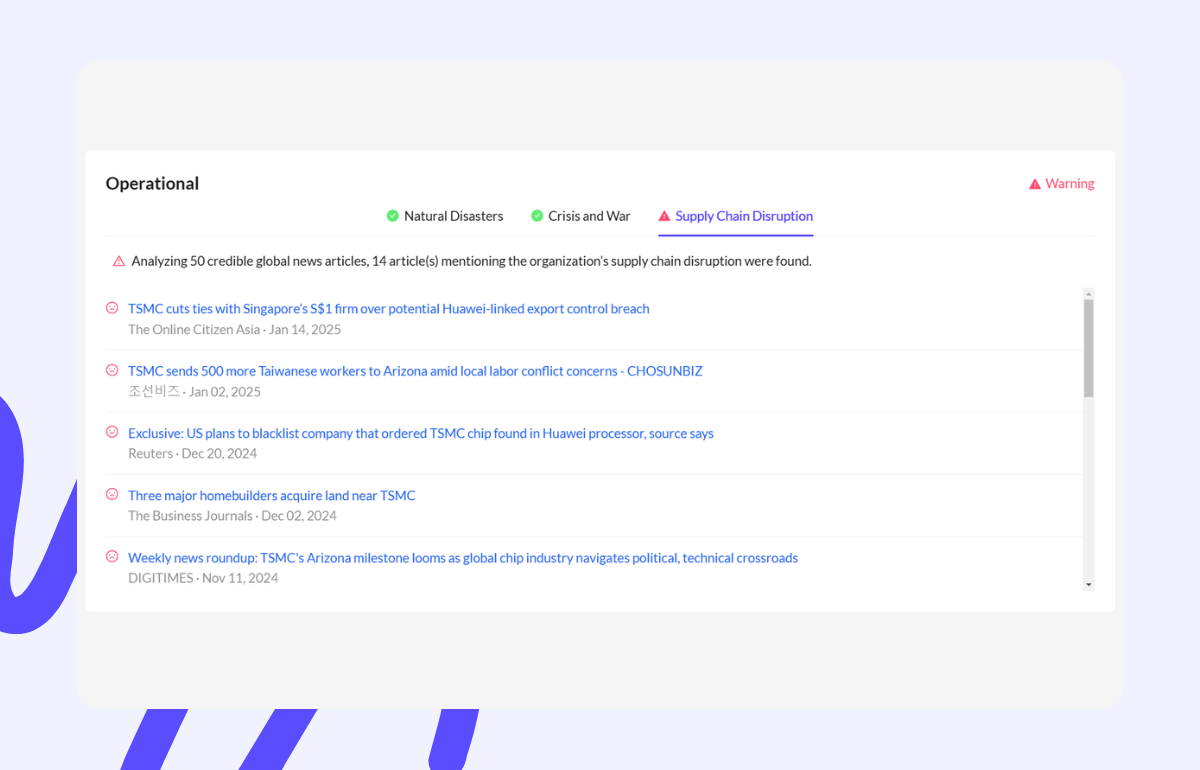

Operational Risks

Supply Chain Disruptions: A review of fifty reputable global news sources resulted in fourteen of those articles particularly referenced supply chain-related problems. These issues are attributed to geopolitical tensions as evidenced by severed relations with a Singaporean company on the basis of export control-related concerns about Huawei.

Supply Chain Disruptions: A review of fifty reputable global news sources resulted in fourteen of those articles particularly referenced supply chain-related problems. These issues are attributed to geopolitical tensions as evidenced by severed relations with a Singaporean company on the basis of export control-related concerns about Huawei.

External shocks include two natural disasters and ten geopolitical crises that were observed in the past month; it is noteworthy that none of these directly impacted TSMC's operations.

Regulatory Pressures and Compliance

Sanctions and Legal Issues: Ten of the fifty-sample articles discussed issues related to sanctions, while nine mentioned court cases. For example, the US-led export bans have forced TSMC to halt the shipments of AI chips to China, thereby illustrating the dire consequences of regulatory pressures.

Sanctions and Legal Issues: Ten of the fifty-sample articles discussed issues related to sanctions, while nine mentioned court cases. For example, the US-led export bans have forced TSMC to halt the shipments of AI chips to China, thereby illustrating the dire consequences of regulatory pressures.Risk Ratings: The feature of regulatory compliance at TSMC is highlighted by a "WARNING" rating, which mirrors the ongoing concerns regarding cross-border regulatory risks.

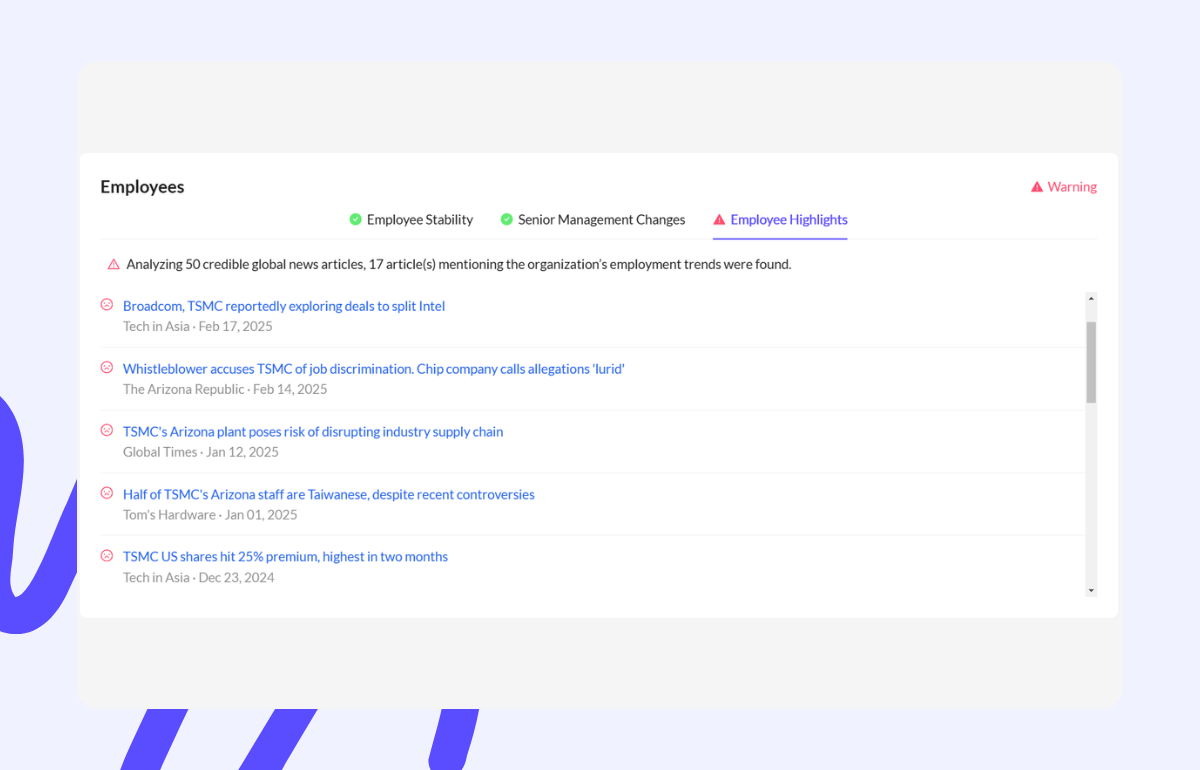

Worker and Employee Issues

Headcount Trends: Manpower levels register a 6-month headcount decline of 7.21% and 12-month drop of 10.72%, reflecting ongoing retention problems.

Headcount Trends: Manpower levels register a 6-month headcount decline of 7.21% and 12-month drop of 10.72%, reflecting ongoing retention problems.Tenure & Leadership: Median employee tenure is 4.3 years, with no recent senior management IT hires in the past year. Additionally, 17 of 50 articles discussed employment trends, including an Arizona class-action lawsuit alleging discriminatory hiring and talent poaching (with competitors like Huawei allegedly offering triple salary).

Reputational and Market Sentiments

Media Coverage: All 50 articles reviewed mentioned TSMC's reputation, with headlines suggesting a 25% premium on U.S. shares and political scandals.

The company was fined $16,000 for the death of an employee at one of its Arizona plants, thereby illustrating how operational failures can instantaneously translate into reputational risks.

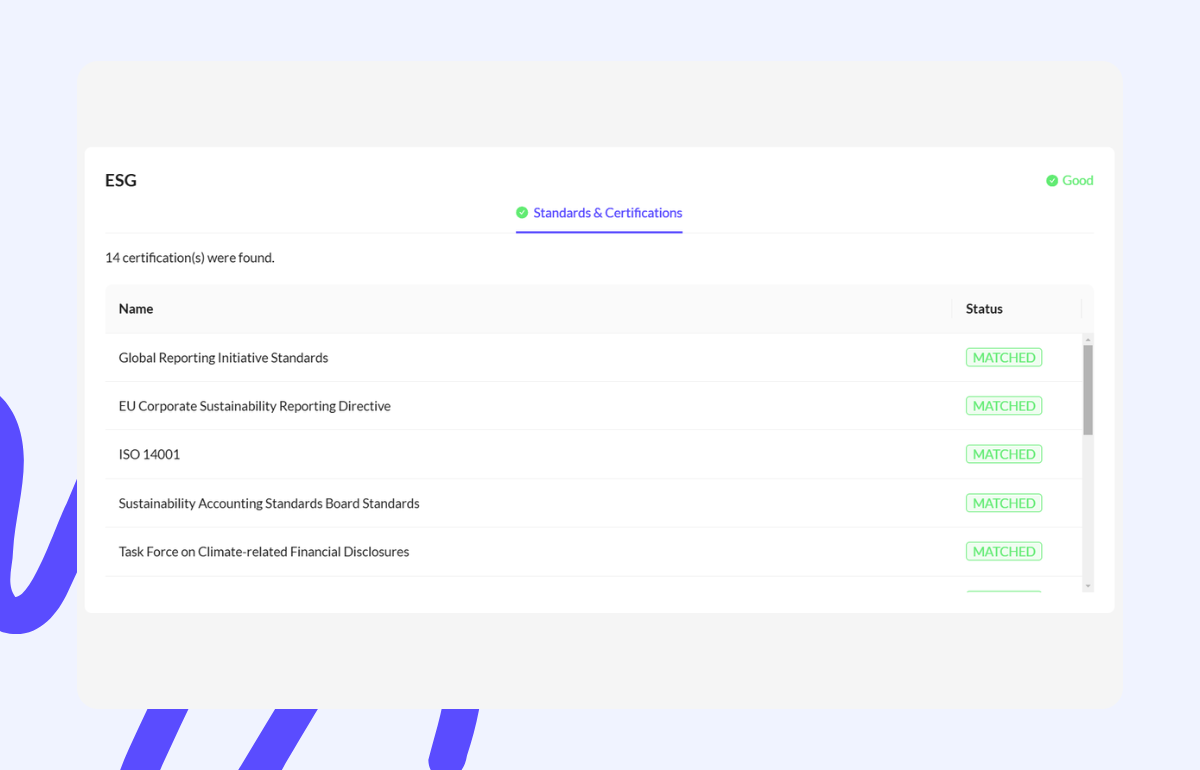

ESG & Digital Footprint

ESG Status: In spite of the alerts issued, TSMC has an ESG rating of "GOOD".

ESG Status: In spite of the alerts issued, TSMC has an ESG rating of "GOOD". Digital Metrics: TSMC's official website is approximated to draw 863,000 visitors monthly and spends $48.64K yearly on IT spending—statistics that indicate its strong digital footprint amidst the current uncertainty.

Conclusion

In as exposed and influential a business as semiconductor production, TSMC's numerical risk profile is instructive: though operational resilience and good ESG practice afford some measure of protection, supply chain management, regulatory compliance, and labor stability are very much concerns. As these numbers imply, the effective mitigation of such risks will be paramount if it is to retain its leadership in an evolving global context. According to the Riskify Non-Financial Risk Report.

Capital markets respond: A delicate equilibrium

The agreement has set off a lot of activity in the capital markets. Investors are watching closely the effects of this shift in production strategy on TSMC's margins and its market competitiveness globally. Several key market reactions are noted:

Stock Volatility: Despite TSMC still being a bellwether for the technology sector, investors are increasingly being motivated by fears of the high expense of manufacturing in the United States as opposed to Taiwan.

Investor Confidence: The agreement has provided investors with greater assurance, with numerous analysts stating that a stronger U.S. Supply chains can help counter systemic risks.

Long-Term Growth Prospects: Strategic onshoring, underpinned by the comprehensive risk management framework as ordered by Riskify, positions TSMC more favorably in an increasingly competitive industry.

The capital markets must now contend with the challenge of balancing the potential advantages of enhanced national security and business resilience with rising production costs and geopolitical risk.

Looking Ahead

As TSMC begins this new phase of growth, the dual focus on financial performance and non-financial risk management will be of the utmost importance. Riskify's innovative analysis indicates that prosperity in today's globalized economy is not only gauged by bottom-line reports, but also necessitates the effective management of operational, regulatory, and reputational risks. Thank you for your ongoing interest in further developments in this continuing saga.

.png&w=3840&q=75)